Property tax exemption due to winter storm available to qualified Caldwell County residents

By Kristen Meriwether, Editor LPR

If your property was damaged at least 15 percent during the Feb. 15 winter storm, you may qualify for a temporary property tax exemption, according to a March 12 press release from the Caldwell County Appraisal District.

The deadline to file the exemption is May 28, 2021.

The exemption only applies to qualified property, which include:

Tangible business personal property used for income production if the owner filed a 2021 rendition; An improvement to real property, which would include residential buildings (homes), commercial buildings (businesses), industrial buildings (manufacturing), multi-family buildings (apartments), and other real property buildings; and certain manufactured homes used as a dwelling.

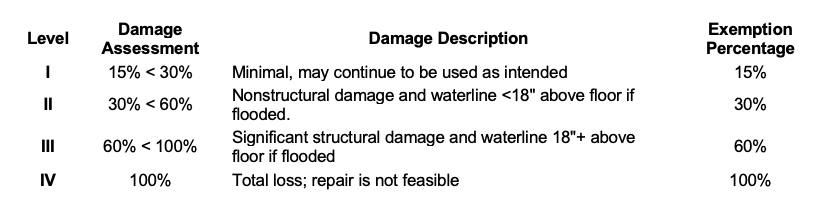

According to the release, the appraisal district determines if the property qualifies by assigning a damage assessment rating of Level I, II, III, or IV. They will rely on information from a county emergency management authority, the Federal Emergency Management Agency (FEMA) or other appropriate sources like insurance adjusters or repair estimates when making this determination.

“The amount of the exemption is determined by multiplying the building (note: this is the value for the structure only, land is not qualified property and land value is not included in the calculations) or personal property value, as applicable, by the exemption percentage based on the damage assessment level and is then multiplied by a proration factor (the number of days remaining in the tax year after the date the governor declares the disaster is divided by 365),” the release said. “The proration factor for this disaster is 0.88 (322/365 = 0.88).”

The temporary disaster area exemption expires on Jan. 1 of the first tax year in which the property is reappraised.